nebraska tax withholding calculator

Free for personal use. The Nebraska State Tax Calculator NES Tax Calculator uses the latest Federal tax tables and State Tax tables for 2022To estimate your tax return for 20222023 please select the.

Employer Payroll Tax Calculator Free Online Tool By Incfile

Its a progressive system which means that taxpayers who earn more pay higher taxes.

. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Free federal and nebraska paycheck withholding calculator. Tax Calculators Tools.

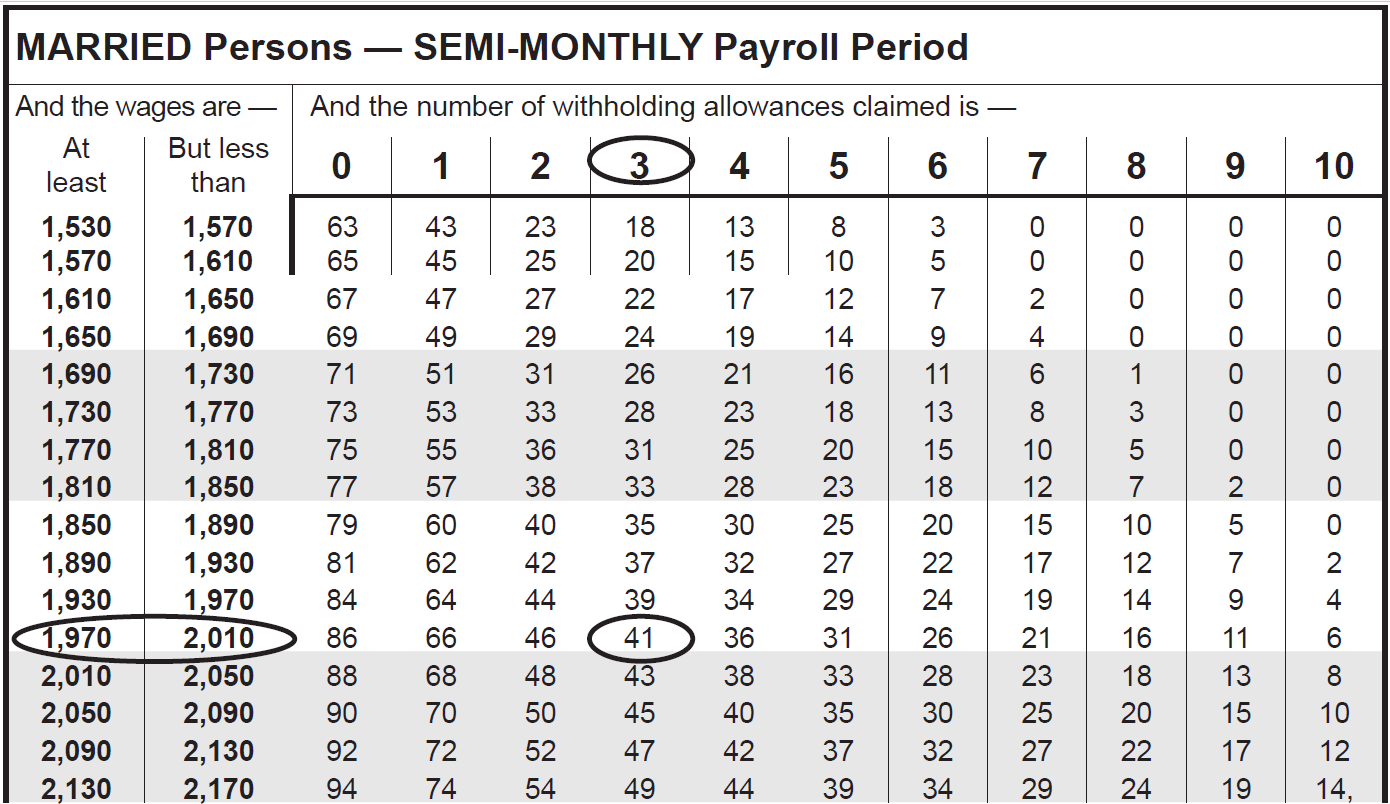

The first deduction that all taxpayers face is fica taxes. Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup. 2022 W-4 Help for Sections 2 3 and 4.

The state income tax rate in. To estimate your tax return for 202223 please select the 2022. Ask your employer if they use an automated.

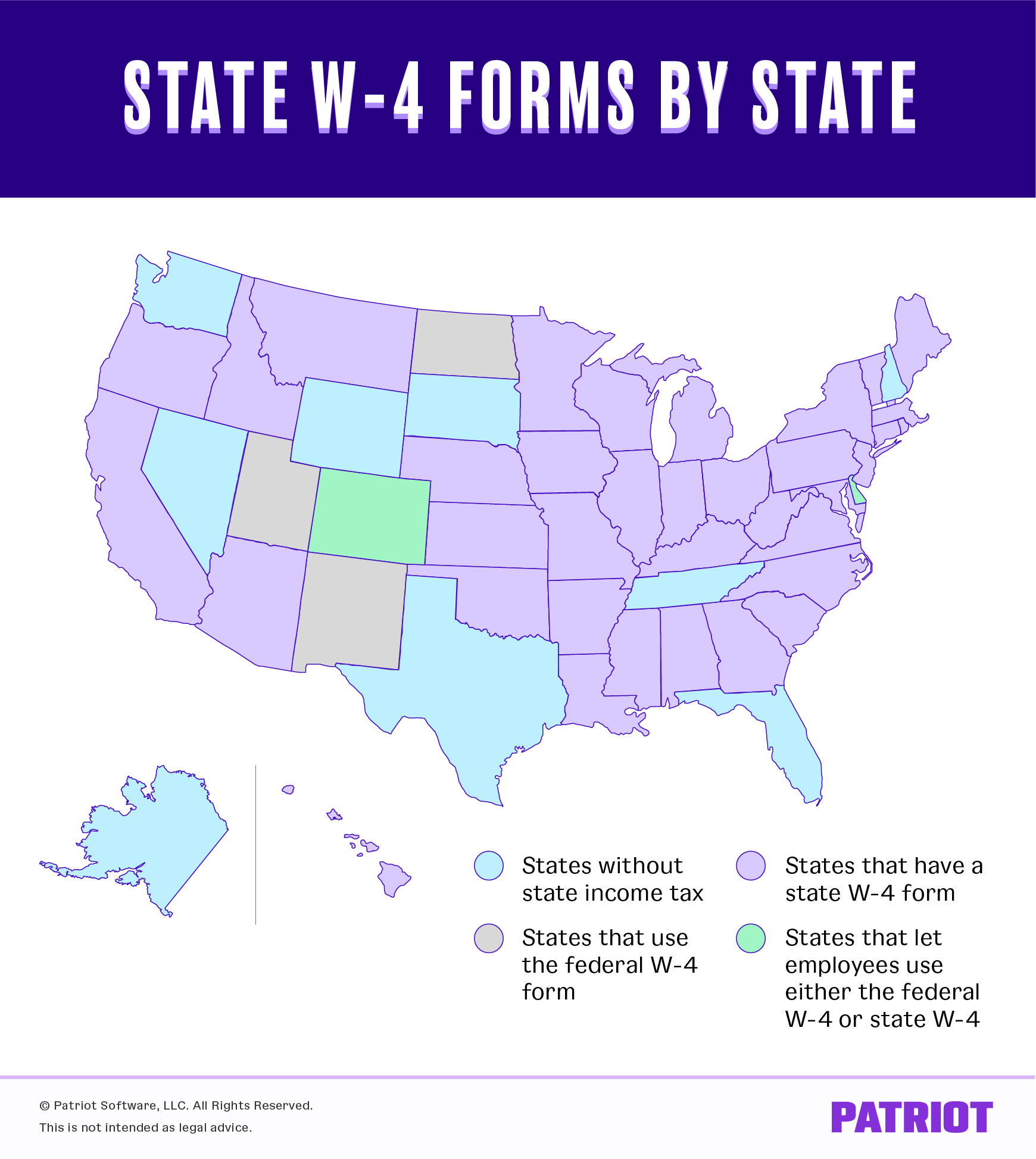

The State of Nebraska has introduced a State Form W-4N to claim marital status and exemptions for State withholding purposes effective January 1 2020. Nebraskas state income tax system is similar to the federal system. Nebraska income tax calculator 2021.

As an employer in Nebraska you have to pay unemployment insurance to the state. The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. 2021 2022 Federal and Nebraska Payroll Withholding General Information.

Form W-4 Tax Withholding. The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State. The 2022 rates range from 0 to 54 on the first 9000 in wages paid to each employee in a.

In 2012 nebraska cut income tax rates across the board and adjusted its tax brackets in an. The Nebraska State Tax Calculator NES Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37.

There are four tax brackets in. W-4 Form Basic -. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

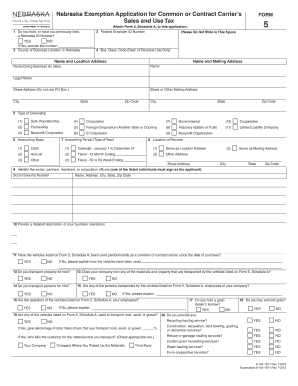

The Federal or IRS Taxes Are Listed. Nebraska Income Tax Withholding Form - Nebraska Income Tax Withholding Form - You must initial be informed about the W-4 as well as the information it takes. To change your tax withholding amount.

Nebraska tax withholding calculator. What is the income tax rate in Nebraska. Free Federal and Nebraska Paycheck Withholding Calculator.

Nebraska Paycheck Calculator Tax Year 2022

Nebraska Hourly Paycheck Calculator Gusto

2019 Withholding Tables H R Block

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Exemption Fill Out And Sign Printable Pdf Template Signnow

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Paycheck Calculator Smartasset

Nebraska Department Of Revenue

How To Fill Out The Personal Allowances Worksheet W 4 Worksheet For 2019 H R Block

W 4 State Withholding Tax Calculation 2020 Based On The State Or State Equivalent Withholding Certificate Sap Blogs

Nebraska Income Tax Ne State Tax Calculator Community Tax

State Withholding Form H R Block

W 4 Withholding Calculator Tax Form Updates H R Block